Investing in Vacation Rentals

Short-term rental sites like Airbnb and VRBO have become wildly popular in the past decade or so, and for good reasons. They allow vacationers a different option from the standard hotels, and in many cases, cut the middleman out of property management. And with little more than a few pictures and a web connection, you can turn your vacation property into a source of income when you’re not using the property.But experts warn that anyone thinking of getting into this line of work should really understand what they’re taking on. Things can and do go wrong; vacationers can damage the property, it might not be booked enough to turn a profit, and the added responsibility of maintaining another house, where things naturally wear out or break from time to time, might not be worth the extra work.

Purchasing a vacation property with the intent to use it as a source of income isn't something to take lightly. There are a lot of factors to consider. One of the first and most significant being how to finance the investment. Wayne Nelson, president of Stockman Bank in Billings, says the structure of the short-term rental loan is much different from a conventional home loan. “This is speculative, there are zoning requirements, there are liability issues, and all those things come into play, so it’s underwritten differently than somebody’s home.”

Nelson says you need to consider a variety of variables, including how the loan will be repaid if it relies on speculative rental income. Additionally, the laws on rental properties could change, or you could suddenly have more competition if other people started renting out their nearby properties. “It’s really an investment and a business; it’s not a home,” says Nelson.

To purchase a short-term rental property as a business, you will need a down payment of at least 25 percent of the purchase price, and the life of the loan would likely be in the 15-20 year range. Insurance for short-term rental properties is different from typical homeowners' insurance, which could eat into your profits. Potential buyers also need to be aware of any zoning and permit requirements that the city or neighborhood might have that could prohibit renting. If you can jump through those hoops and show that you can make the payments even without a rental income, you are much more likely to secure a loan.

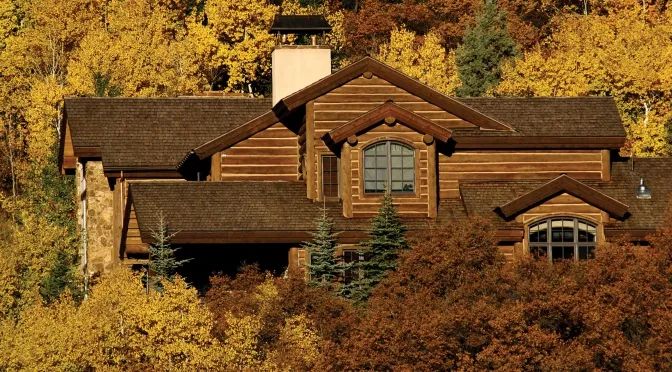

If you do choose to purchase a second home for income, research is critical. As with anything in real estate, location is key. Find a place popular with tourists to ensure a steady stream of renters. Ideally, your rental property would be close to area attractions like lakes or ski resorts as well as grocery stores. Determine your budget and make sure you can cover all the expenses like insurance, maintenance, and cleaning between guests.

Nelson encourages owners to work with an attorney to ensure they have a proper agreement between themselves and a temporary tenant. He also urges those thinking of buying a rental property to speak with a tax advisor to ensure proper reporting of income and expenses. “Make sure you know what you’re doing. Study up on it. Just because you stayed in one that might have worked out just fine, doesn’t mean you know how to run one. And there are risks to doing it,” Nelson says.

by Stephanie Hobby

Originally printed in the pages of Simply Family Magazine’s November 2018 issue.

Never miss an issue, check out SFM’s digital editions, here!